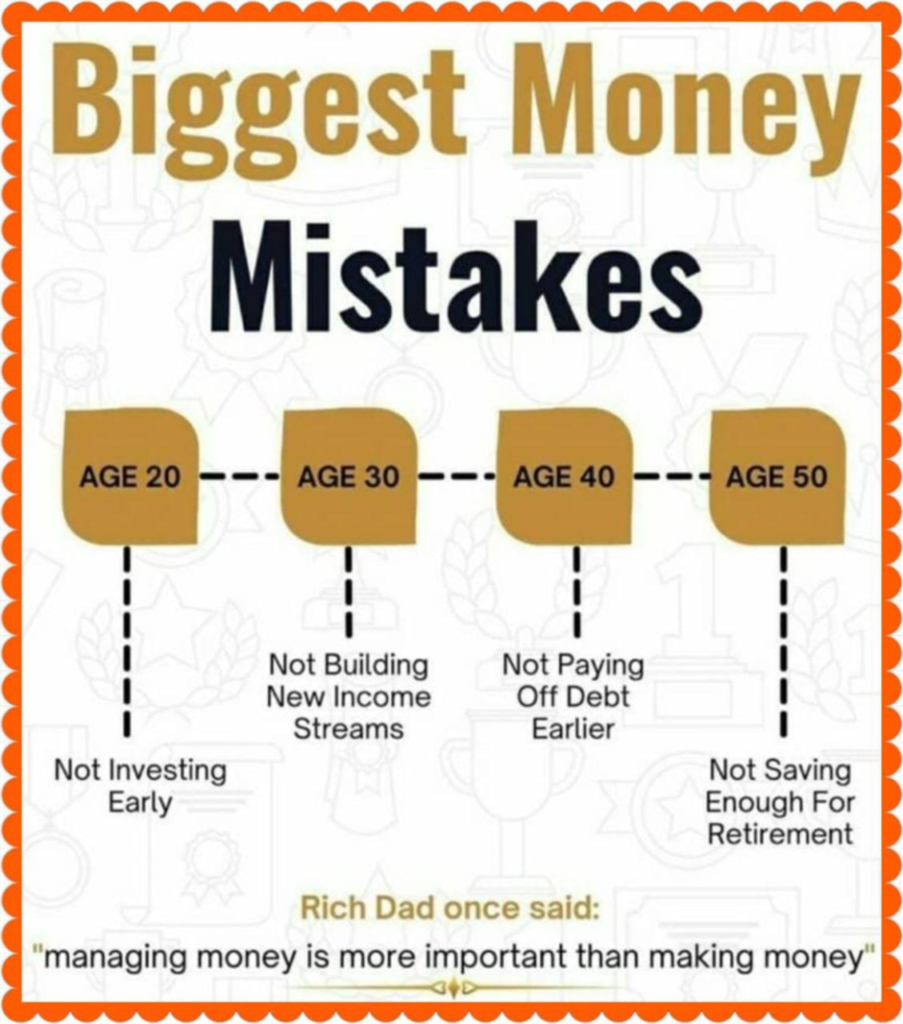

BIGGEST MONEY MISTAKES PEOPLE TEND TO MAKE IN DIFFERENT DECADES OF LIFE

Age 20:

- Mistake: Not investing early.

- Awareness Point: Starting investments in your 20s allows the power of compounding to work in your favor. Even small amounts invested consistently can grow significantly over time.

Age 30:

- Mistake: Not building new income streams.

- Awareness Point: Relying on a single source of income is risky. Diversify your income through side hustles, investments, or passive income opportunities.

Age 40:

- Mistake: Not paying off debt earlier.

- Awareness Point: High-interest debts like credit cards can drain your finances. Focus on clearing debts early to free up money for savings and investments.

Age 50:

- Mistake: Not saving enough for retirement.

- Awareness Point: By 50, retirement planning should be a priority. Ensure you have a solid corpus to maintain your lifestyle post-retirement.

Key Takeaway:

Managing money is more important than making money.”

This reminds us that earning well is insufficient if you don’t manage your finances wisely. Strategic financial planning across all stages of life is crucial.

I rest my case

#FinancialMistakes

#MoneyManagement

#FinancialPlanning

#WealthBuilding

#LifeDecades

#SmartInvesting

#PersonalFinanceTips

#Budgeting

#RetirementPlanning

#FinancialFreedom

#SavingsGoals

#MoneyTips

******************************