Article-1

Setting clear financial goals works like a magnet, attracting opportunities and resources to help achieve them. Whether it’s building a retirement corpus, securing health coverage, or planning your child’s education, having well-defined objectives helps you stay focused, disciplined, and motivated. At SRS Finowise Solution, we help you turn your financial goals into actionable plans, ensuring they align with your aspirations and attract the right outcomes.

Goals are like magnets. They’ll attract the things that make them come true.” It can be adapted for financial awareness as follows:

2. Motivation: Defined objectives keep you committed to your financial journey.

1.Focused Planning: Clear goals lead to tailored strategies for achieving milestones like financial independence or wealth creation.

3.Resource Allocation: Proper planning ensures your investments are aligned with your priorities.

4.Peace of Mind: Achieving goals systematically reduces financial stress and builds confidence in the future

I rest my case

Article-2

Post -2 :BALANCE IS THE KEY IN RISK MANAGEMENT

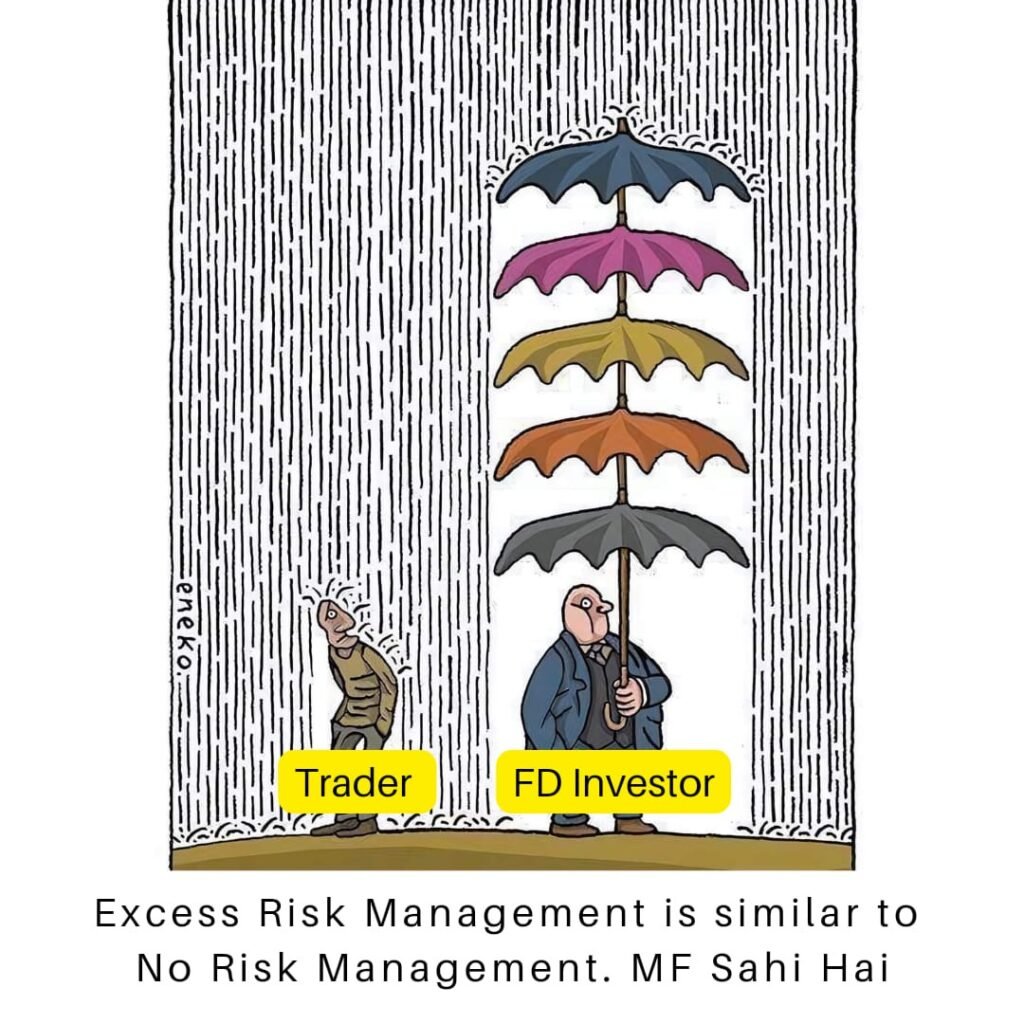

Balance is Key in Risk Management: The image compares two extremes—”Trader” with no protection and “FD Investor” with excessive protection. Both scenarios can lead to inefficiencies. Proper risk management, like mutual funds, strikes the right balance.

Excessive Safety Can Limit Growth: Just like an FD investor holding multiple umbrellas provides unnecessary shelter, being overly cautious with investments like fixed deposits can limit returns and fail to combat inflation effectively.

Mutual Funds Provide Optimal Risk-Reward: The caption “MF Sahi Hai” highlights that mutual funds offer the right balance of risk and reward, providing growth potential while managing risks, unlike trading or overly conservative investments.

#RiskManagement #FinancialPlanning

#BalanceIsKey

#WealthManagement

#InvestmentStrategy

#RiskAndReward

#SmartInvesting

#FinancialFreedom

#InsuranceMatters

#SecureFuture

#RiskMitigation

#FinancialWellness

#ProtectAndGrow

#StrategicPlanning

#MoneyMatters

********************

Article-3

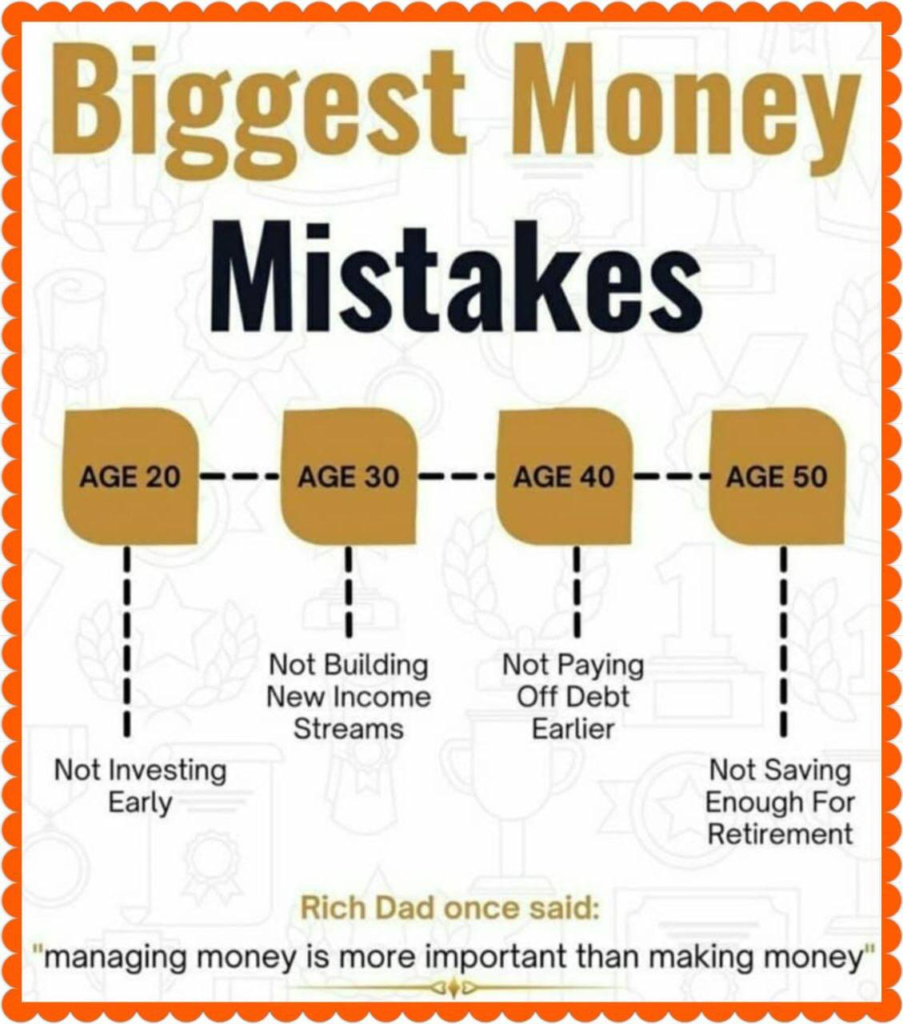

BIGGEST MONEY MISTAKES PEOPLE TEND TO MAKE IN DIFFERENT DECADES OF LIFE

Age 20:

- Mistake: Not investing early.

- Awareness Point: Starting investments in your 20s allows the power of compounding to work in your favor. Even small amounts invested consistently can grow significantly over time.

Age 30:

- Mistake: Not building new income streams.

- Awareness Point: Relying on a single source of income is risky. Diversify your income through side hustles, investments, or passive income opportunities.

Age 40:

- Mistake: Not paying off debt earlier.

- Awareness Point: High-interest debts like credit cards can drain your finances. Focus on clearing debts early to free up money for savings and investments.

Age 50:

- Mistake: Not saving enough for retirement.

- Awareness Point: By 50, retirement planning should be a priority. Ensure you have a solid corpus to maintain your lifestyle post-retirement.

Key Takeaway:

Managing money is more important than making money.”

This reminds us that earning well is insufficient if you don’t manage your finances wisely. Strategic financial planning across all stages of life is crucial.

I rest my case

******************************

Article-4

RISK IS GOOD IF YOU ARE PREPARED

💡In various aspects of life, taking risks can lead to growth, innovation, and success.

💡However, the key lies in being well-prepared before diving into the unknown.

💡Whether it’s a business venture, an investment opportunity, or a personal endeavor, a thorough understanding and preparation can significantly enhance the chances of a positive outcome.

This image highlights the importance of calculated risks in investments. The tiger symbolizes “risk,” while the prepared man represents readiness and courage.

Key Takeaways for Investors:-

- Risks are essential for growth but must be managed wisely.

- Preparation and professional guidance turn risks into opportunities.

- Expert advice ensures smart, goal-aligned financial decisions.

“Take Guidance Before Investing” to face risks confidently and achieve long-term success.

Have a great day

I rest my case

Whatsapp link to connect directly

15 Free consultation.Please fill out the Google form. Click the link below

https://forms.gle/V4N4G2arHLy9AjUC6

Article-5

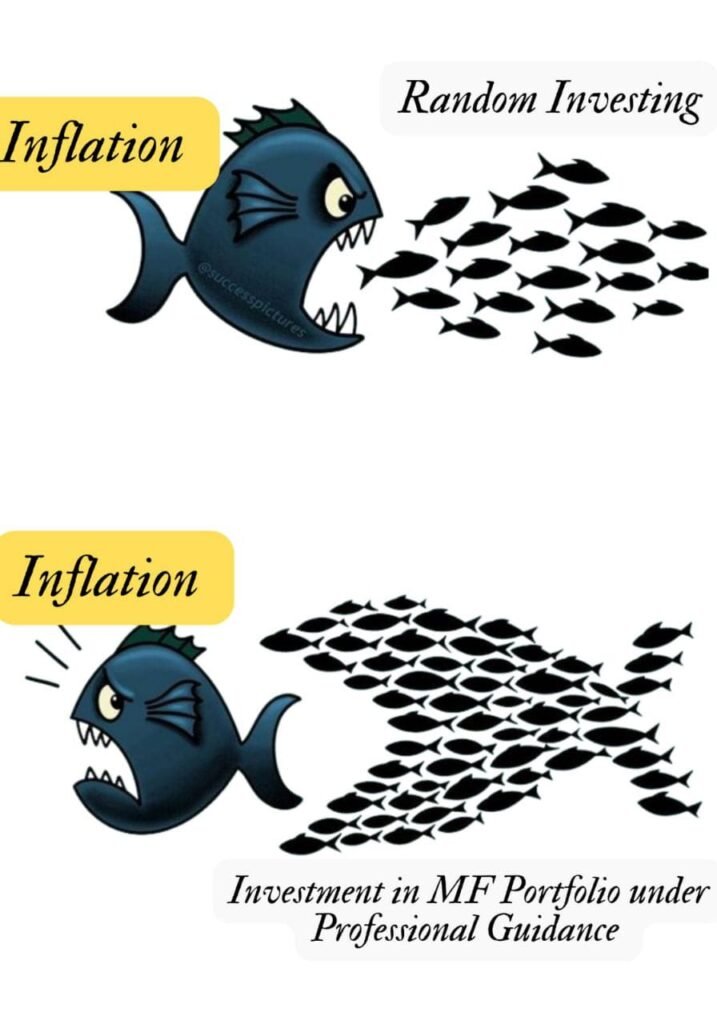

Random investing versus investing in a mutual fund (MF) portfolio under professional guidance in the context of inflation:

- Top Part:

- A big fish labeled Inflation will consume small, scattered fishes labeled “Random Investing.”

- This symbolizes how inflation can erode the value of unplanned or fragmented investments, leaving the investor vulnerable to losses.

2. Bottom Part:

- The same Inflation fish is now stopped by a united group of small fishes (symbolizing a well-structured MF portfolio).

- These small fishes, working together like bigger fish, represent investments in mutual funds under professional guidance.

- The message highlights that proper diversification and expert management in mutual funds creates a strong defense against inflation.

Benefit to Customers:

- Random Investing: Scattered and unorganized investments may fail to keep up with inflation, leading to financial setbacks.

- Mutual Fund Investing: Professional guidance helps pool and diversify investments, making them resilient to inflation. This structured approach ensures better returns, financial growth, and security for investors

Key Takeaway:

By opting for professional mutual fund portfolios, customers can effectively combat inflation and achieve their long-term financial goals.

I rest my case

WhatsApp link to connect directly

15 Free consultation. Please fill out the Google form. Click the link below

https://forms.gle/V4N4G2arHLy9AjUC6

Article no-6

Wake up copying is not same as Investing

- “WAKE UP” is a strong call to action, urging investors to take responsibility and be aware of their financial decisions.

- “COPYING IS NOT THE SAME AS INVESTING”: It highlights the danger of blindly copying others when making financial or investment decisions. Following trends, influencers, or friends without understanding can lead to poor outcomes.

- “TAKE PROFESSIONAL GUIDANCE BEFORE INVESTING” reinforces the importance of seeking advice from a qualified financial advisor before making investments.

Customer Perspective and Financial Advisor’s Initiative:

- Customer Interest:

- Many customers often mimic others’ investments without understanding their risk profile, goals, or the market.

- This message educates customers to avoid the common pitfalls of uninformed investing.

- Intention of Financial Advisor:

- The goal is to encourage potential investors to consult a financial advisor who can provide tailored financial planning and guidance.

- Advisors can help customers:

- Identify their financial goals (retirement, education, etc.).

- Understand their risk tolerance.

- Avoid herd mentality or impulsive decisions.

- Relevance to Investor Awareness:

- It highlights that investing requires knowledge, strategy, and personalized advice—not imitation.

- Blindly following others can lead to financial losses and missed opportunities.

Key Takeaway for Investors:

- Wake up and take control of your finances.

- Copying others is not a strategy—it’s a gamble.

- Always consult with a professional financial advisor for informed, goal-based investment decisions.

I rest my case

WhatsApp link to connect directly

15 Free consultation. Please fill out the Google form. Click the link below

https://forms.gle/V4N4G2arHLy9AjUC6

Article 7

Like Sugar is Poison for Tea, Impatience is Poison for Investing

Think of tea with too much sugar—it’s unhealthy and ruins the flavor. Similarly, impatience can poison your investments. Here’s why patience is essential for financial success:

Why Impatience Hurts:

- Emotional Decisions: Reacting to market dips can lead to losses.

- Chasing Quick Gains: Risky, unplanned moves often backfire.

- Disrupting Compounding: Frequent changes interrupt long-term growth.

Rewards of Patience:

- Time in the Market: Long-term investments weather volatility.

- Power of Compounding: Money grows exponentially with time.

- Goal Alignment: Ensures you achieve milestones like retirement or education.

How to Stay Patient:

- Set Goals: Define clear financial objectives.

- Stick to a Plan: Follow a roadmap, even during market swings.

- Seek Professional Guidance: Work with a financial advisor to stay on track and make informed decisions.

- Focus on Long-Term Gains: Ignore short-term noise and trust the process.

Patience in investing, like moderation in sugar, ensures lasting rewards. Stay focused, seek guidance, and let time work its magic!

I rest my case

Click on below link to connect on whatsapp

15 mins Free Consultation. Click below link.Please fill the Google Form

https://forms.gle/V4N4G2arHLy9AjUC6