SIP: A Wealth-Building Tool Only When Used Wisely

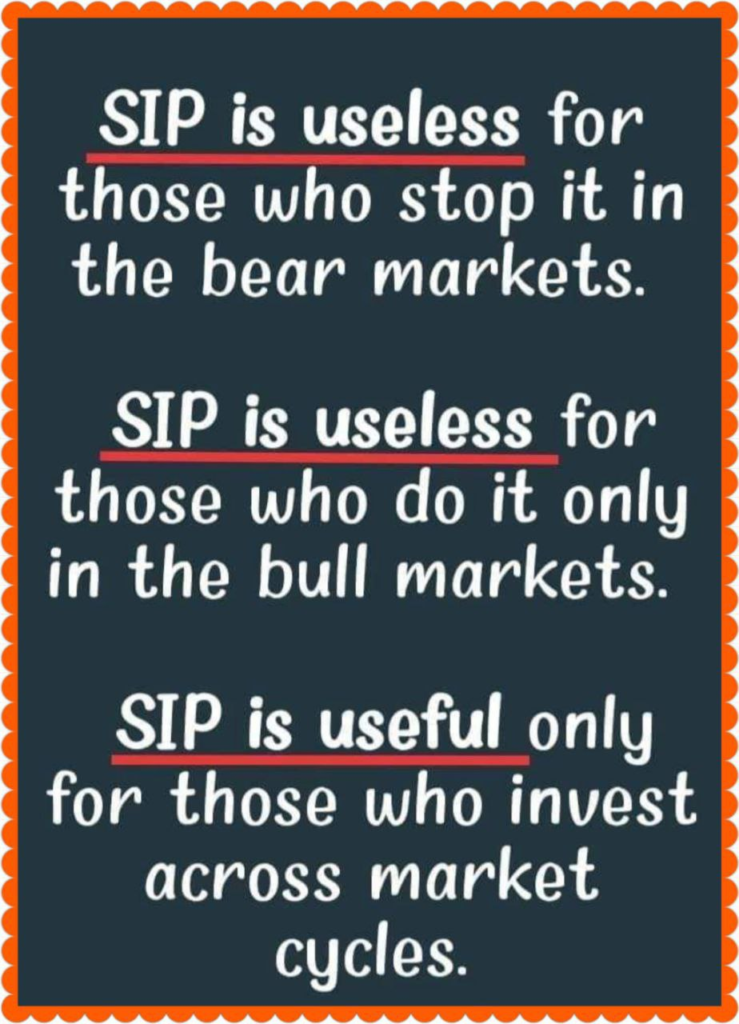

Systematic Investment Plans known as SIPs, have become one of the most preferred investment methods in India. They allow you to invest small amounts regularly in mutual funds, helping you achieve your long-term financial goals with help of professional guidance. However, as highlighted in the image above, SIPs are only effective if you approach them with the right mindset and strategy. Let us break down the meaning conveyed in the image and understand how to get the best out of SIPs.

Why Stopping SIPs During Bear Markets is a Mistake?

A bear market is when stock prices are falling, often leading to panic among investors. Many individuals stop their SIPs during such times, fearing further losses. This is a significant mistake. Take professional guidance before stopping SIP. Bear markets provide an excellent opportunity for SIP investors to accumulate more units at lower prices. This process, known as rupee cost averaging, ensures that when markets recover, your returns are maximized. This is the time when investors make the wrong decision. Investors need to align their investments based on future goals with the help of a financial Coach

Stopping your SIP during a bear market is like pausing your health insurance when you fall ill—it’s the time when you need it the most?

SIPs During Bull Markets Alone Don’t Work?

A bull market, on the other hand, is when stock prices are rising. Many people start SIPs during this phase, lured by the promise of high returns. While this is not inherently wrong, investing only during a bull market reduces the potential benefits of rupee cost averaging. If you invest only when the market is high, your average purchase price per unit will also remain high, which can lower your overall returns.

To become man of the match one needs to stick to the ground till the end game. So in the same way you need to stick to your investment seeing both the ups and downfalls of the market which is favourable for your investment with patience and discipline

SIP investments need consistency. Limiting your contributions to bull markets robs you of the opportunity to build a robust portfolio that can weather different market cycles.

The Key Takeaway: Invest Across Market Cycles

The true power of SIPs lies in their ability to work across market cycles—bull, bear, or sideways. By investing regularly, regardless of market conditions, you:

1. Benefit from Rupee Cost Averaging: This strategy ensures you buy more units when prices are low and fewer when prices are high, averaging out your cost per unit over time.

2. Reduce Emotional Decision-Making: Markets are unpredictable, and timing them accurately is nearly impossible. SIPs help you stay disciplined, eliminating the urge to make impulsive decisions based on market trends.

3. Harness the Power of Compounding: The longer you stay invested, the more your returns compound, multiplying your wealth over time.

A Practical Example for Indian Investors

Let’s consider an investor who started a SIP of ₹10,000 per month in an equity mutual fund. Suppose the market witnessed a sharp decline for two years, followed by a strong recovery. By continuing the SIP during the downturn, the investor accumulates more units at lower NAVs (Net Asset Values). When the market rebounds, the higher number of units generates substantial returns. Had the investor paused the SIP during the bear phase, they would have missed out on the recovery benefits.

Conclusion

SIPs are a long-term wealth-building tool that works best when used consistently across market cycles. The essence of the message in the image is clear—don’t let market fluctuations deter you. Whether the market is bullish or bearish, stay invested. The journey of wealth creation requires patience, discipline, and a forward-looking approach.

As an investor, remember that SIPs are not about timing the market; they are about time in the market. Stay committed, and your financial goals will thank you!

I rest my case